Your fleet insurance coverage ought to present a single streamlined coverage to cowl all of your autos. It’s a necessary answer for companies managing a number of autos. This fleet insurance coverage information supplies invaluable suggestions that will help you choose the perfect fleet insurance coverage supplier in your wants. It additionally explores cowl choices, value concerns and key advantages.

Whether or not your enterprise operates only a few autos or manages an intensive combined fleet, understanding fleet insurance coverage can considerably improve your operational effectivity.

What’s Fleet Insurance coverage?

Fleet insurance coverage is particularly tailor-made for companies managing three or extra autos, enabling all autos to be coated underneath one complete coverage. It simplifies administration with a single renewal date and unified documentation, whereas providing flexibility to simply add or take away autos. Insurance policies can cowl vehicles, vans, vans, coaches, and even specialised agricultural autos.

Widespread Fleet Insurance coverage Phrases Defined

Most purchasers of insurance coverage shall be aware of normal motor insurance coverage phrases like complete, third get together, hearth, and theft. Nevertheless, sure fleet insurance coverage phrases warrant clarification:

- Automotive Fleet Insurance coverage: Excellent for companies with a number of vehicles, similar to gross sales groups or cellular employees. It will possibly additionally embrace fleets for bigger households searching for purely private use.

- Business Fleet Insurance coverage: Covers business autos together with vans and vans.

- Firm Fleet Insurance coverage: Common time period overlaying any company-owned autos.

- Fleet Insurance coverage Any Driver: Permits any licensed driver authorised by your enterprise, offering operational flexibility. It might have an age restriction or specify car restrictions for sure drivers.

- Mini-Fleet Insurance coverage: Designed for smaller companies working between 2-15 autos.

Plan Insurance coverage supplies a spread of Motor Fleet Insurance coverage choices. Full our on-line quote type, and our skilled brokers will contact you to debate appropriate insurance coverage cowl.

Sorts of Fleet Insurance coverage Protection Accessible

When selecting a fleet insurance coverage coverage, it’s essential to think about the extent of protection:

- Contractors Fleets: Covers business autos utilized by building contractors transporting their very own supplies.

- Courier Insurance coverage: Tailor-made for companies steadily delivering clients’ items on routes with a number of drops.

- Haulage: Appropriate for companies transporting items over longer distances often with a single drop-off location.

- Personal & Public Rent Fleets: Supplies cowl for the carriage of passengers by taxi, chauffeur, and personal rent companies.

- Self-Drive Rent Fleet Insurance coverage: For car rental corporations to insure their clients to drive throughout every of their car rental durations.

- Combined Car Fleets: Insurance policies accommodating a mixture of auto varieties with various gross car weights and makes use of.

Advantages and Extra Protection Choices

Typical fleet insurance coverage insurance policies typically embrace advantages similar to Many different tailor-made options:

- Cowl for any licensed driver (with age restrictions)

- Versatile month-to-month funds

- Uninsured loss restoration

- New-for-Previous car substitute (typically solely applies to autos lower than 1 yr previous)

- Medical bills and private results cowl (cowl and particular limits will fluctuate)

- 24-hour emergency, claims, and authorized helpline

- Non-compulsory UK and European roadside help

Many different tailor-made options are additionally accessible.

Get a Fleet Insurance coverage Quote From Us

Our new fleet quote type is now reside – quick, easy, and designed to get you the duvet you want with out the trouble.

Important Elements Affecting Fleet Insurance coverage Prices

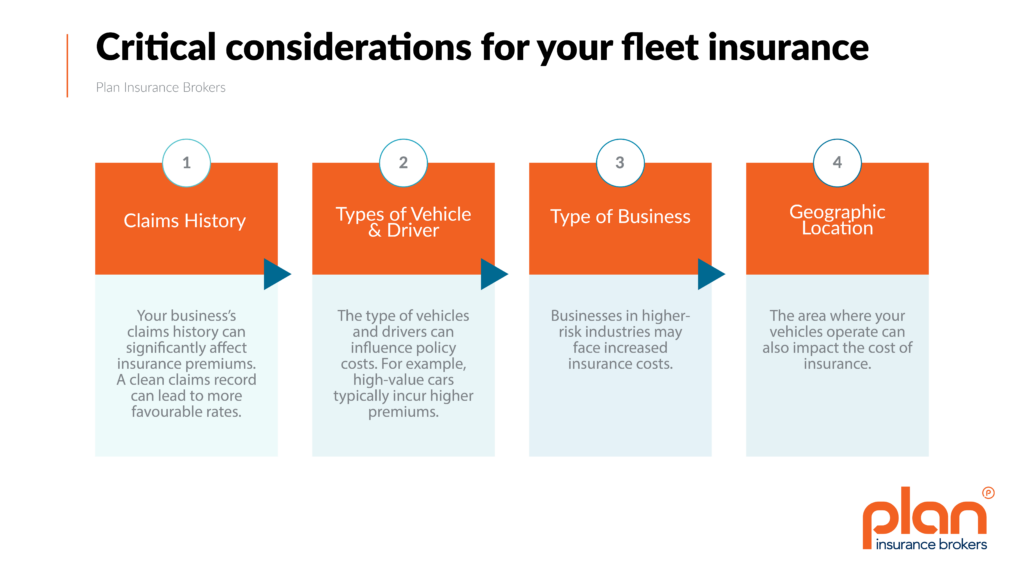

Fleet insurance coverage prices rely upon numerous components together with:

- Claims Historical past: A clear Confirmed Claims Expertise (CCE) can considerably decrease premiums.

- Car and Driver Varieties: Premiums fluctuate in response to car worth and driver profile.

- Enterprise Sort: Increased-risk industries sometimes face larger premiums.

- Operational Space: Geographic location influences threat and thus premium prices.

A No Claims Bonus (NCB) applies to particular person car insurance coverage insurance policies. Nevertheless, insurance coverage underwriters will rely closely on a CCE which stands for Confirmed Claims Expertise. A CCE is used to evaluate the driving requirements and threat offered by your fleet to motor insurers. Sustaining a confirmed claims expertise that demonstrates as few claims as potential, in addition to proscribing these claims to a minimal whole worth is essential to acquiring a aggressive fleet insurance coverage premium.

Your confirmed claims expertise will present an correct claims historical past from current years. For that motive, it helps insurers assess threat and set truthful premiums. A powerful CCE can result in decrease prices and fewer restrictive cowl phrases, as a reward to companies with fewer claims.

Can Telematics Decrease Your Fleet Insurance coverage Premium?

Telematics know-how supplies detailed insights into driver behaviour and car efficiency, doubtlessly decreasing your fleet insurance coverage premiums via:

Actual-time Monitoring: GPS knowledge to handle fleets extra effectively.

Value Optimisation: Lowering mileage not solely saves on operational prices however the much less mileage travelled means the much less chance of a motor accident occurring.

Enhanced Security: Monitoring driver behaviour serves to enhance compliance and security.

Improved Buyer Service: Dependable and punctual service enhances your model popularity.

Diminished Insurance coverage Prices: Correct knowledge decreases fraud threat, helps declare reporting accuracy and reduces declare response instances. Intervening shortly is understood to be a key issue when searching for to keep away from claims prices from escalating.

Selecting the Finest Fleet Insurance coverage Firm For You

Selecting an acceptable insurer is necessary to make sure appropriate cowl aligned with your enterprise necessities and funds. Consider suppliers primarily based on:

- Constructive buyer evaluations and stable popularity.

- Environment friendly and simple claims processes.

- Aggressive pricing balanced with complete protection.

Your skilled fleet insurance coverage govt at Plan will have the ability to inform you concerning these choice components in relation to the accessible insurers: Get A Fleet Insurance coverage Quote.

For detailed claims info, go to the Affiliation of British Insurers.

How A lot Does Fleet Insurance coverage Value?

Fleet insurance coverage value will depend on a number of components, together with car sort, operational location and exercise, claims historical past, driver ages and your chosen insurance coverage dealer. A fleet insurance coverage dealer can act in your behalf to obviously current your enterprise’s dangers to insurers, doubtlessly serving to you safe aggressive premiums.

Not like private car insurance coverage, fleet insurance coverage utilises Confirmed Claims Expertise (CCE), which impacts premiums primarily based in your claims historical past fairly than a No Claims Bonus (NCB).

What Different Enterprise Insurance coverage Could I Want?

You might take into account discussing the next insurance coverage choices together with your business insurance coverage account govt:

Plan Insurance coverage Brokers supply complete insurance coverage packages tailor-made particularly to your trade and threat profile, offering personalised help, threat assessments, and compliance documentation. For additional recommendation on well being and security compliance, seek the advice of assets just like the Well being and Security Govt (HSE).

Get Your Personalised Fleet Insurance coverage Quote

Fleet insurance coverage is essential for managing enterprise autos successfully. Understanding the sorts of cowl, value components, and supplier choice standards helps safeguard your operations and streamline your fleet administration.

Prepared for a tailor-made fleet insurance coverage answer? – Get Your Fleet Insurance coverage Quote.

Discover out why 96% of our clients have rated us 4 stars or larger, by studying our evaluations on Feefo.